CAPD: Comment to the Federal Trade Commission Workshop

Understanding Competition in Prescription Drug Markets: Entry and Supply Chain Dynamics

The Coalition for Affordable Prescription Drugs (CAPD) is a diverse group of large employers, labor unions, health plans, public sector employees and retirees, and other stakeholders who partner with pharmacy benefit managers (PBMs) to help manage health care costs so that they can continue to offer affordable, accessible health and drug benefit coverage to their employees and members.

As the Federal Trade Commission (FTC) examines important topics related to the drug supply chain and rising drug prices, its critical to keep in mind where prices originate: drug manufacturers – and drug manufacturers alone – set the price for prescription medicines.

We are fortunate to live in a time of unprecedented medical breakthroughs. Manufacturers are developing treatments and cures for diseases like Hepatitis C that improve and extend the lives of patients. We all want patients to have access to these life-saving and life-changing medicines, but the innovative power of these medicines is rendered moot when they are kept out of patient reach due to unaffordable prices.

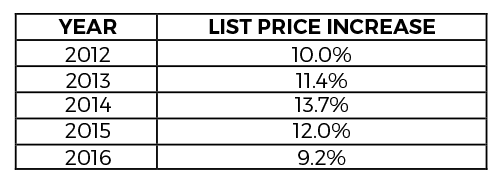

The most immediate and impactful change to help make medicines more affordable for patients would be for manufacturers to set a responsible price. Yet, manufacturers’ prices continue to rise1, increasing by more than nine percent in 2016 alone, following double-digit increases every year since 2012.

Pharmacy benefit managers (PBMs) use their size and scale to negotiate a lower net price for prescriptions and help drive down costs on behalf of employers, unions and other health care purchasers. When the starting point for those negotiations is exceedingly high, the cost implications ripple throughout the system.

Fortunately, as the drug price debate continues, the focus is increasingly turning to understanding drug manufacturers price-setting schemes. At a Congressional hearing in June, Gerard Anderson, Professor of Medicine at Johns Hopkins University School of Medicine, testified2, “Many people have argued that the list price is irrelevant because few entities actually pay the list price. However, the list price is often used to determine the amount of cost sharing that many patients will pay. Since the list price is the only price that is publicly announced, it becomes the basis for many cost‐sharing agreements. Thus, patients are harmed when the list price goes up.”

Pharmacy benefit managers have kept the net prices that their clients pay steady, increasing 3.5 percent the same year3 that manufacturer list prices rose 9.2 percent. That difference represents savings for PBM clients – the employers, unions, retirement plans and government programs that provide health care coverage to 266 million Americans.4 More than 90 percent of these savings are passed on, and the savings are used to lower out-of-pocket costs and premiums for employees and members.

In addition to delivering savings through negotiations with drug manufacturers, PBMs support better health outcomes and help reduce health care costs through multiple strategies. Deep clinical expertise helps ensure the safest, most effective and affordable medications are dispensed, which in many cases is a generic drug. Patient-focused tools and programs also help to improve medication adherence, which is critically important, with one in every two Americans living with a chronic disease.

PBMs deploy their clinical expertise to review drugs for safety and efficacy to create formularies that deliver effective clinical outcomes and affordability. As an example, PBMs identify when a patient could achieve the same health outcomes through the use of clinically equivalent, lower cost generic drugs. In 2016, generic drugs accounted for 89 percent of prescriptions written, but only 26 percent of total drug costs. That sum translated to $253 billion in savings across the U.S. health care system in 2016 alone.5

Additionally, PBMs manage specialty medicine programs, which are only 2 percent of prescriptions but account for 40 percent of total drug spending.6 PBMs identify specialty trends and develop clinical program to engage members, increase medication adherence and reduce costs.

The savings generated by PBMs in Medicare Part D plans provide a valuable example of private sector solutions working effectively in the public sector. A recent study7, conducted by Oliver Wyman Associates, projects that PBMs will save the Centers for Medicare and Medicaid Services (CMS) and Part D beneficiaries $896 billion over ten years. It also estimates that Part D premiums, which have remained stable over the years, would be 66 percent higher without PBMs.

PBMs’ ability to effectively negotiate on behalf of their partners and drive cost-savings for employers, unions, government programs, and other PBM clients – and therefore lower costs for patients – relies on marketplace competition and the ability of generic alternatives to get to market. Facilitating faster reviews of generics and biosimilars, identifying off-patent drugs with little or no generic competition, and ending anti-competitive practices that keep safe, effective alternatives off the market are key to managing rising drug costs for patients.

CAPD is appreciative of the opportunity to share our perspective on the role of PBMs in driving down costs for payors and patients and the importance of marketplace competition in lowering prescription drug costs. We stand ready to work with all stakeholders to find new ideas and build on existing strategies to increase competition in the prescription drug marketplace and help make prescription drugs more affordable for the patients who need them to get and stay healthy.

1 http://www.imshealth.com/en/thought-leadership/quintilesims-institute/reports/medicines-use-and-spending-in-the-us-review-of-2016-outlook-to-2021

2 https://www.help.senate.gov/imo/media/doc/Anderson4.pdf

3 http://www.imshealth.com/en/thought-leadership/quintilesims-institute/reports/medicines-use-and-spending-in-the-us-review-of-2016-outlook-to-2021

4 https://www.pcmanet.org/wp-content/uploads/2016/11/ROI-on-PBM-Services-FINAL.pdf

5 http://www.gphaonline.org/media/generic-drug-savings-2016/index.html

6 https://morningconsult.com/wp-content/uploads/2016/04/IMS-Institute-US-Drug-Spending-2015.pdf

7 http://www.affordableprescriptiondrugs.org/app/uploads/2017/06/ow-pbm-med-d-report-june-2017_final-1.pdf